Strength

comes with DISCIPLINEStrength comes with discipline

Protecting you and yours starts with a powerful plan

With thorough planning and knowledgeable execution, wealth can be preserved for many generations to come. At DAI, we listen to our clients and learn about what is important to them—their lifestyle, family and ideals–so we can build a long-term plan that meets their unique and changing needs. We collaborate with our clients’ other trusted partners including lawyers and accountants serving as our client’s advocate and working to ensure their wealth is protected, taxes are minimized, appropriate relationships and documents are in place and that their assets have the opportunity to continue to grow. All of this can lead to financial peace of mind.

DAI Wealth Management Services for Trusts and Estate include:

- Wealth Transfer

- Custom Trust Solutions

- Estate Planning & Services

- Tax Strategies

A lasting legacy is built on a strong, shared vision

At DAI, we strive to help our clients transfer not only their wealth to the next generation but also their values. We work with families to develop of a culture of open communication, respect and purpose. Through our Wealth Planning services, our clients identify and solidify their vision, mission and goals as well as the benefit that working together as a family to preserve their wealth. With DAI’s focused planning and counsel, families are able to establish, sustain and share a lasting legacy.

- Financial Planning

- Family Education and Governance

- Wealth Transfer and Tax Strategies

- Philanthropy

Peace of mind comes from authentic collaboration

Individuals and families of significant wealth experience a growing number of concerns, issues and daily duties associated with their success. This can become cumbersome and interfere with enjoying the life they have built. DAI’s experience in working with high net worth clients across the country is an invaluable asset when collaborating with existing Family Offices. Our knowledge base and holistic approach to our individual client’s financial realm allows us to provide essential guidance, bring unity and effectively oversee ongoing plans and their implementation.

Individuals and families of significant wealth experience a growing number of concerns, issues and daily duties associated with their success. This can become cumbersome and interfere with enjoying the life they have built. DAI’s experience in working with high net worth clients across the country is an invaluable asset when collaborating with existing Family Offices. Our knowledge base and holistic approach to our individual client’s financial realm allows us to provide essential guidance, bring unity and effectively oversee ongoing plans and their implementation.

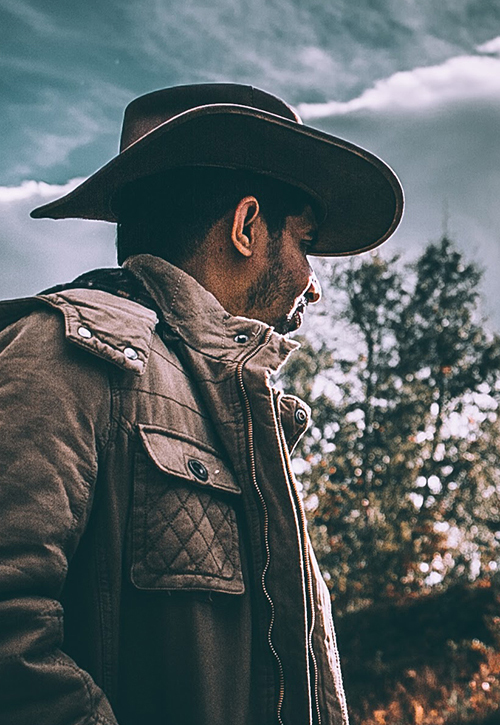

Steadfast

Be Dedicated in the Pursuit of What Gives You Purpose.

DAI believes that inside every self-made person is the ability to act on instinct and make critical decisions quickly and confidently. They operate freely with an entrepreneurial mind dedicated to great purpose—all while applying prudent discipline. It’s the intellect of the self-made, of the successful, of the steadfast.